Everything that You need to know about Mutual Funds in Nepal

A mutual fund is a company that pools money from many small as well as institutional Investors and invests in stocks, bonds and other investment securities. It is managed and operated by a portfolio manager. After the issuance of the Mutual Fund Directives. 2067 by the Securities Board of Nepal (SEBON), the mutual funds have started in operation in Nepal. After the Issuance of the regulations, class A banks started to establish and operate mutual funds in Nepal. 'Siddhartha Investment Growth Scheme' run by Siddhartha Capital Limited was the first mutual fund in Nepal after the directive. It was the closed end fund with the maturity period of 5 years,

In Nepal, as per the Mutual Fund Directives 2067, the money collected from mutual funds is invested by the portfolio manager in different shares, bonds, government securities, and fixed deposits. The return or profit from such investment is distributed to the unit holders in a proportional manner. Investor purchasing the share/unit of mutual fund is known as unit holder. Value of each unit is called Net Assets Value (NAV).

History of Mutual Funds In Nepal

NCM mutual fund, 2050

Before the issue of Mutual Fund Directives in 2067, NIDC Capital Market established NCM mutual fund. 2050(1993/94). This was an open end fund that had a par value of Rs 10. Later, the fund was converted to close end fund and listed in the NEPSE again.

Citizen Unit Scheme, 2052

Likewise, Citizen Investment Trust (C operated Citizen unit scheme 2052 which was also an open end fund, Citizen Unit Scheme 2052 with a par value of Rs. 100 came into operation in the year 1995, s an open end scheme and provides regular income In the form of dividend to the unit holders

NCM Mutual Fund, 2059

During the termination of NCF 1st Mutual Fund, 2050, the gave the investors an option to refund or to participate in another scheme called NCM Mutual Fund, 2059 labilities of NCM First Mutual Fund, 2050 was converted into NCM First Mutual Fund 2009. it was a closed end with maturity of 10 years and traded at NEPSE

Types of Mutual Funds In Nepal

Open-Ended Mutual Fund

The open end fund is available for sale at any time and is not listed in the secondary market i.e. Nepse. It can be bought and sold at any time on the basis of Net Asset Value (NAV). The open-ended mutual funds can issue shares on the basis of demand. If the investors want to sell their shares, the fund will buy those shares. There is no need to purchase from existing shareholders. The shares of an open-ended fund are priced daily based on their day to day Net Asset Value (NAV).

The open-ended mutual fund scheme has just recently begun in Nepal. NIBL Ace Capital Limited is operating Nepal's first open-ended mutual fund scheme which is known as 'NIBL Sahabhagita Fund'. NIBL Sahabhagita Fund issued 50 million units at a par value of Rs 10 in Jestha 19, 2076.

Closed Ended Mutual Funds In Nepal

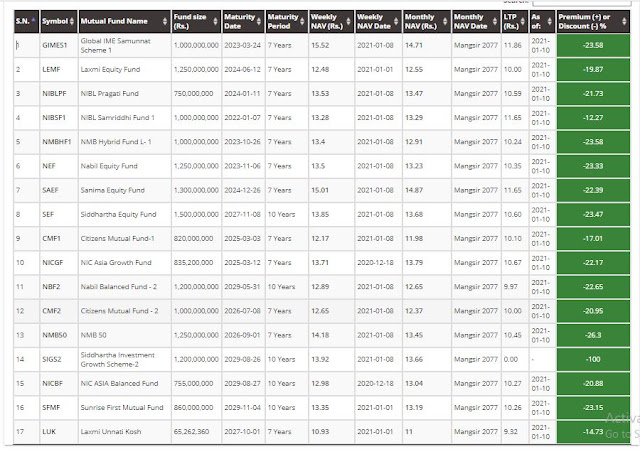

The closed ended fund usually issues a specified number of units for a fixed time period. Closed funds raise money through primary offering to the general public and institutions. The funds thus collected are listed and traded on the Nepal Stock Exchange (NEPSE). After the expiration of the stipulated time period, the investor gets back the profit including the investment on the unit. Currently, there are 19 closed-ended mutual fund schemes operating in Nepal. These schemes, as a whole, have collected almost Rs 26.09 billion from the investors and have invested in the shares, debentures and fixed deposit products. Investors can purchase the units of these closed end funds from the secondary market of Nepal i.e NEPSE

Why you need to Invest In Mutual Funds Of Nepal?

Professional money management

Professional fund managers who are actively involved in the field of investing, manage the mutual funds. With adequate knowledge, analytical tools and strategy, they can make the wise investing decision than the average investors.

Minimum Investment

Mutual Funds are easily affordable. One can purchase 100 units of the scheme at a mere Rs 1000. You don't have to make huge investment in the mutual funds. You can always start small.

Diversification

Investors can easily diversify their investment while investing in the mutual funds. Even with a small capital, he/she can put money in the funds. The funds then make investment in various invest-able securities. Thus, diversification is possible.

Liquidity

The next advantage of the mutual fund is their liquidity. Any investors willing to sell their mutual fund units can directly sell to the fund (Open end) or in the stock market (Closed end). Thus, investment made in the mutual funds is highly liquid,

Low transaction Cost

The transaction cost which buying/selling mutual funds is also relatively low. If the fund is closed end and traded in the stock exchange, then the transaction cost amounts to the same as share trading. Likewise, while selling to the funds directly, as in open end, the cost may be as per the fund manager.

Safety

Mutual Funds are comparatively safer than other investment. They are highly diversified. Likewise, Securities Board of Nepal (SEBON) regulates any mis doings by the fund managers.

Participation of Small Investors

Minimum Requirement To Operate Mutual Funds In Nepal

The minimum requirement to operate mutual funds in Nepal are:

1. Minimum paid up capital of Rs 1 billion

2. Minimum 5 years of service in relevant field

3. Minimum 3 years of continuous profit

4. Appointment of at least 5 fund supervisor, a fund manager and a depository

5. License requirement for fund manager and depository.

Structure Of Mutual Fund In Nepal

The structure of mutual funds in Nepal is as follows:

Fund sponsor (e.g. Nabil Bank Limited)

Fund manager (e.g Nabil Investment And Banking Limited)

Fund supervisor Depository (e.g Nabil Investment And Banking Limited)

Mutual fund (e.g. Nabil Equity Fund)

How to select the best Mutual Fund in Nepal

The popular saying goes – one shoe does not fit all same is with the selection of mutual funds here in Nepal. The fund which might be the right fit for you, is not necessarily the right option for another investor. So while choosing a mutual fund for investing your money, it is necessary to determine your investment objective as considering your time horizon.

The right way to invest- Find the mutual fund that will help you meet your investment goals. Now, the way to go about investing is finding a fund that is in favor with your investment goals. And you can find that by simply answering these 2 questions:

1. For how long do you want to invest?

2. How much risk are you willing to take?